Eva Golinger's fraudulent claims

By Aleksander Boyd

Caracas 05.03.05 | Eva Golinger the "...attorney leading the investigation of the CIA and the US Government involvement in the coup and in the ongoing destabilization campaign in Venezuela..." [1] appears as the registrar of a legal entity (DOMESTIC NOT-FOR-PROFIT CORPORATION ) called "Venezuela Solidarity Committee" [2]. Golinger's findings about the aforesaid investigation have been posted in a website registered, according to WHOIS, by journalist Jeremy Bigwood called Venezuelafoia.info. On 07 May 2004 Golinger sent an email with the following remarks:

I do have a non-profit organization, established legally under the laws of New York State, but it has never received a penny from any government, including that of Venezuela. Any measly income the non-profit has earned has come from private donations of individuals, primarily US citizens, interested in supporting efforts to “accurately inform the US community about social and political developments related to Venezuela.” In this sense, funds from the non-profit were used to finance my webpage, www.venezuelafoia.info, and I can assure you, as an attorney, I keep clear records of all deposits, withdrawals and purchases made with funds from the non-profit. I have no interest in evading or violating regulations or hiding absolutely anything from anyone. In fact, I have nothing to hide…[bold added]

The following claim appears in the Venezuelafoia.info website:

This site is funded by the Venezuela Solidarity Committee/National Venezuela Solidarity Network ("VSC"), a 501 (c)(3) non-profit organization dedicated to providing accurate information about social and political developments in Venezuela . The VSC is funded entirely by private donations. For more information please contact:[email protected], or make your tax-exempt contribution through Paypal, e-mail or snailmailto keep this site running and to support VSC's other projects.

One can also read in the Venezuelafoia.info website how the VSC urges American people to help Venezuela by engaging in the following activities [3]:

- Receive e-mail updates and Action Alerts

- Write an article, op-ed, or letter to the editor

- Write a letter to my U.S. Representative or Senator

- Organize a presentation or film screening in my community

- Become a member of the National Venezuela Solidarity Network ($25.00 donation is tax deductible, make a $50-100 donation and receive video documentary about the April 2002 coup)

- Join a delegation going to Venezuela

The Department of the Treasury of the Inland Revenue Service (IRS) has strict regulations as to the lobbying and political activities that are permitted to 501(c)(3) non-profit organizations. Please read the following excerpts in that respect [4]:

If any of the activities (whether or not substantial) of your organization consist of participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for public office, your organization will not qualify for tax-exempt status under section 501(c)(3). Such participation or intervention includes the publishing or distributing of statements.

It can be argued that urging the public to write Senators and Congressmen to put pressure on foreign policy making and disseminating official propaganda –such as the film “The Revolution will not be televised”- may not, under any circumstances, be perceived as normal activities of a non-profit organization created with the aim of “providing accurate information about the social and political developments in Venezuela” [sic] given the notorious pro-Chavez character of its director. Furthermore Golinger did write open letters in favour of Hugo Chavez to presidential candidate John Kerry [5] [6].

Not to be confused by what a 501(c)(3) non-profit organization means the IRS provides tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code ("IRC") section 501(c)(3) [7]. The IRS website also has this information about Publication 78 [8]:

Cumulative List of Organizations described in Section 170(c) of the Internal Revenue Code of 1986, is a list of organizations eligible to receive tax-deductible charitable contributions. You may consult the paper version of this Publication, which is available for sale from the Government Printing Office or available for viewing at many public libraries. This online version is offered to help you conduct a more efficient search of these organizations. Please note that some organizations eligible to receive tax-deductible contributions may not be listed in this publication. In addition to the paper and online versions of Publication 78, you may verify an organization's tax-exempt status and eligibility to receive tax-deductible charitable contributions by requesting to see an organization's IRS letter recognizing it as tax-exempt or directly calling the IRS (toll-free) at 1-877-829-5500.

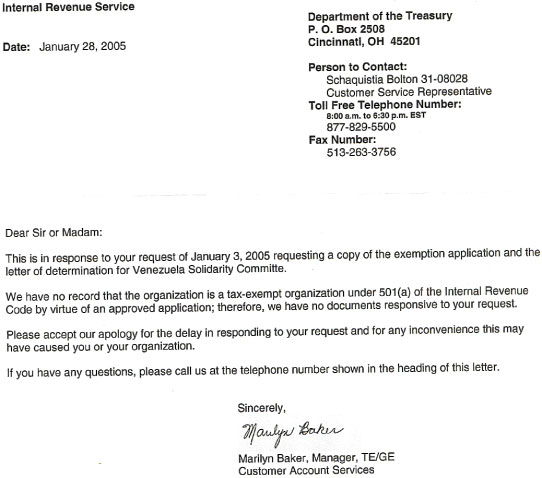

A search in the cumulative list of organizations for the claimed 501(c)(3) "Venezuela Solidarity Committee" or the "National Venezuela Solidarity Network" in the registry of the IRS returns no records [9], so a trusted Vcrisis collaborator called the IRS office to find out whether or not contributions given to Golinger's "Venezuela Solidarity Committee" were tax-exempt and also whether or not it was registered as a 501 (c)(3) non-profit organization. The IRS answered negatively to both queries. He then requested the IRS, in writing, for a copy of a Determination Letter recognizing Golinger's organization's tax-exempt status. The result of this query produced this letter:

In the introduction of IRS' Publication 557 [10] one can read the following information:

this publication discusses the rules and procedures for organizations that seek to obtain recognition of exemption from federal income tax under section 501(a) of the Internal Revenue Code (IRC). It explains the procedures you must follow to obtain an appropriate ruling or determination letter recognizing your organization's exemption, as well as certain other information that applies generally to all exempt organizations. To qualify for exemption under the IRC, your organization must be organized for one or more of the purposes designated in the IRC. Organizations that are exempt under section 501(a) of the IRC include those organizations described in section 501(c). Section 501(c) organizations are covered in this publication.

To conclude, Golinger was remunerated once by the Chavez administration via the Venezuela Information Office for certain legal work, even though at the time of receipt of payment no records of her existed in the NY's BAR database nor in that of Washington DC. In this instance absence of official information vis-a-vis the status of the "Venezuela Solidarity Committee" demonstrate yet again that Golinger has no qualms in publishing unsubstantiated claims to mislead the public. Golinger is one of the very few foreigners who can call to Chavez live television rants and actually speak to the nation during his programmes. Her so called independent investigations of NED grants have gained her the sympathy of Chavez himself; so much so that Golinger enjoys 'special treatment' from the regime, as it was reported by sources who witnessed how a presumed chavista official, with enough rank to bypass immigration controls in Maiquetia airport, whisked her through immigration upon latest arrival in Venezuela without even bothering to have her passport stamped. In a time when terrorism is an ever growing menace, supporters, allies, so called ‘independent collaborators’ and employees of terrorist regimes ought to be under surveillance at all times. Ergo, in light of the findings of this report [11], the US administration should be well advised to examine carefully the endeavours of this person.

Read more about Eva Golinger's fraudulent activities here.

send this article to a friend >>